Charles wanted to both thank you and help you discover some of the stuff that our Premium screener can do for you. Continue reading

Author Archives: David Snowball

Rolling toward the one fund you can trust

The knock on mutual fund performance numbers is that they’re static and arbitrary snapshots that give the illusion of being meaningful. What do you learn from looking at a fund’s five-year performance number? Mostly, you learn that the fund, through skill or luck, did well in the market conditions that obtained between December 2012 and December 2017. Sadly, we don’t have any reason to think those two dates are particularly important (why December 2012? ‘cause it was five years ago, duh!) and we don’t have any Continue reading

Alfred E. Baron: What, me worry?

I wonder, sometimes, if I’m more irked by high fund fees because they degrade my returns or because they reflect an annoying sense of entitlement on the part of managers who think we owe them a lifestyle far more opulent than our own. At base, is my objection practical or Continue reading

Shukran jazīlan! Trugarez! Xièxie! Go raibh maith agaibh! E molte grazie!

Likewise merci, danke and, more than all, thanks!

On December 17th, I wrote a note to the 7,000 or so folks on our mailing list. The sad part of the note was reminding folks of the end of our associate’s relationship with Amazon which had so long provided our ability to cover our “hard” bills such as webhosting and email. The glad part was announcing a challenge gift of $2000, offered by three MFO readers who wanted to do the best they could to support us. Their offer was straightforward: we’ll put in a dollar of our own money for every Continue reading

Funds in registration

Fund advisers are required to file prospectuses for proposed funds with the SEC; the SEC has 75 days to review the filing. If the SEC doesn’t object, then the adviser is free to launch – or to not launch, which is more common than you think – the proposed fund. Funds placed in registration in December will “go live” in February or March 2018. This month’s filings include three actively-managed ETFs, two conversions of existing funds and one Continue reading

Briefly Noted

Updates

In December’s story, “There’s no idea so dumb that it won’t attract a dozen ETFs,” I derided the notion of blockchain ETFs. That’s because they have so few meaningful investments; there just aren’t many publicly traded blockchain-focused firms to build a portfolio around. I described their investment universe as “a small, motley collection of firms that recently changed their names to blockchainify them (360 Capital Financial suddenly became 360 Blockchain), over-the-counter stocks, foreign small caps and recent IPOs.”

Shortly thereafter, Long Island Iced Tea Corporation – literally, guys who make Continue reading

December 1, 2017

Dear friends,

Welcome to Winter. It’s my favorite time of the year. My students, with their hummingbird-like metabolisms, are loath to surrender their shorts and sandals even now.

The midwinter holidays ahead – not just Christmas but a dozen other celebrations rooted in other cultures and other traditions – are, at base, expressions of gratitude. They occur in the darkest, coldest, most threatening time of year. They occur at the moment when we most need others, and they most need us. No one thrives when they’re alone and each day brings 14 to 18 hours of darkness. And so we’ve chosen, from time immemorial, to open our Continue reading

The Terrific Twos

We thought we’d start catching up with the 130 U.S. equity funds which have passed their second anniversary but have not yet reached their third, which is when conventional trackers such as Morningstar and Lipper pick them up. As Charles has repeatedly demonstrated, the screener at MFO Premium allows you to answer odd and interesting questions. As I, and other users of the site, have asked him, “would it be possible to …?” Charles has almost always responded with a cheerful “let me see what I can do. I’ll get back to you.”

Two days later, the screener has Continue reading

Launch Alert: The Touchstone adoptees

On October 30, 2017, Touchstone Investments finalized the adoption of a suite of Sentinel funds. The Sentinel funds were somewhere between “solid” and “outstanding,” depending on the fund in question, but they were not at all well known. Given the maturity of the mutual fund marketplace, Sentinel saw little prospect for growth and little reason to continue serving as adviser to the funds. Like a number of other firms, including UMB which recently sold the Scout Funds, Sentinel looked to sell the funds after (80) years in the business. Touchstone Investments stepped up.

Nine Sentinel funds were involved in Continue reading

There’s no idea so dumb that it won’t attract a dozen ETFs

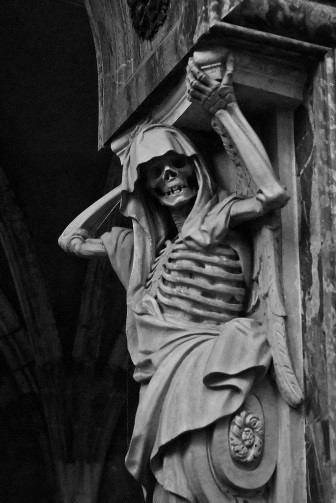

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se.

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se.

Not quite as skeptical as Hamilton Nolan seems to be. Mr. Nolan, whose writing style occasionally makes Continue reading