Many people are heartsick after watching the stock market’s gyrations. Some of the people who are queasiest are the young investors who thought, “this is so easy!” as they booked a year’s worth of profit in a single morning, trading meme stocks or NFTs or cryptos or any of a dozen other securities they could barely explain, much less analyze. More will find their moment of reckoning as they confront Continue reading

Category Archives: Mutual Fund Commentary

On Risk

On Risk

Justice Potter Stewart’s most famous line is the one that he most regretted:

I shall not today attempt further to define the kinds of material I understand to be embraced within that shorthand description [“hard-core pornography”], and perhaps I could never succeed in intelligibly doing so. But I know it when I see it, and the motion picture involved in this case is not that. Concurring Opinion, Jacobellis v. Ohio, 378 U.S. 184 @ 197 (1964)

In 1981 he lamented “having said what I said about obscenity—that’s going to be on my tombstone.”

Many investors have the same difficulty with risk that Justice Stewart had with “hard-core pornography,” they are not quite able to define it though they’re pretty sure they know it when they see it. Given that we seem to have entered a period when risk is going to be on a lot of minds, it’s important to understand what it actually is Continue reading

Biggest Bang for your Buck

Fresh from the MFO Archives! An update on a classic essay.

20 equity funds with the best capture ratios over the entire market cycle

Capture ratio is a sort of “bang for your buck” summary. It’s calculated by dividing a fund’s upside capture (a fund that typically rises 1.1% when the market rises 1% has an upside capture of 1.10) by its downside capture (a fund that typically falls 1.1% when the market falls 1% has a downside capture of 1.10). Capture ratios greater than 1.0 reflect funds that Continue reading

January 1, 2022

Dear friends,

Merry Christmas and Happy New Year!

Let’s hope it’s a great one.

If you think I’m a bit late on the former, it’s because you think of Christmas as a day rather than as a season. Not so! In 567, the Council of Tours established that the twelve days between Christmas and Epiphany – also sometimes known as “Chip’s son’s birthday” – were to be treated as a single holiday. (Her sister was born on Christmas Day so it makes sense she waited to give David a reason to celebrate the other end of the holiday.) In England, in Continue reading

Building a Multi-Strategy Portfolio – Managed Fidelity Roth IRA

The Mutual Fund Observer writes for the benefit of intellectually curious, serious investors— managers, advisers, and individuals—who need to go beyond marketing fluff, beyond computer-generated recommendations, and beyond Morningstar’s coverage universe.

The quote above had a big impact on me in July 2019 when I was first introduced to Mutual Fund Observer, and I became its most enthusiastic fan. I began contributing to the monthly newsletter shortly thereafter. I appreciate the efforts that have gone into creating and maintaining MFO by Professor Continue reading

Investing in 2022: The Indolent Portfolio

Each year, usually in our February issue, I walk through my portfolio. It gives some folks the shivers, and others, a nice sense of superiority. On the whole, it seemed like a good idea to accelerate the schedule this year. I’ll walk through it using the same five-part process that we’ve urged on others.

Step One: Assess my goals and resources

My overarching goal is to have a portfolio that I don’t have Continue reading

Terrific twos: Intriguing funds not yet on your radar

Most funds don’t show up on investors’ radar until they have at least a three-year record, which is also the point at which they receive their inaugural Morningstar rating. That’s a generally sensible, sometimes silly constraint since many funds that have been operating for fewer than three years are actually long-tested strategies managed by highly experienced professionals, which are just coming to market in a new form. Relatively recent examples of such funds include Andrew Foster’s Seafarer Overseas Growth & Income (SFGIX), Rajiv Jain’s GQG Partners Emerging Markets Equity (GQGPX), Abhay Deshpande’s Centerstone Investors (CETAX), and Amit Wadhwaney’s Moerus Worldwide (MOWNX). Collectively, those four managers had overseen more than Continue reading

Morningstar isn’t very good at mutual funds … and that’s a good thing

Running them, not assessing them.

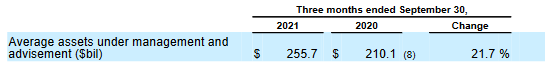

Morningstar runs a booming, global asset management business. They have $255 billion under management and advisement (as of 9/30/21).

Of that, $50.5 billion are assets under management, primarily through their Managed Portfolios and Institutional Asset Management services.

They also have 116,627 Morningstar.com Premium members and 17,182 Morningstar Direct licensees.

The managed portfolios traditionally used outside, actively managed funds. In 2018, Morningstar decided Continue reading

The Younger Defenders

A handful of young funds, by luck or design, have managed the rare feat of peer beating returns since inception with risk-rated, risk-adjusted returns (MFO rating, Ulcer rating) and risk metrics (downside deviation, bear market deviation, down market deviation).

The US stock market is approaching the most extreme valuation levels of the past 150 years, at least as measured by Continue reading

Life in the Jungle: Terrific at Two, Dead at Four

Our last review of “the Terrific Twos” ran in January 2019. We highlighted 10 funds. Here’s what became of them.

Four of the ten were liquidated: Ladder Select Bond (LSBIX), which earned fours stars but never drew over $20 million; BlackRock Emerging Markets Equity Strategies (BEFAX) died in April 2020; WisdomTree Dynamic Long/Short US Equity (DYLS) was Continue reading