Updates

In December’s story, “There’s no idea so dumb that it won’t attract a dozen ETFs,” I derided the notion of blockchain ETFs. That’s because they have so few meaningful investments; there just aren’t many publicly traded blockchain-focused firms to build a portfolio around. I described their investment universe as “a small, motley collection of firms that recently changed their names to blockchainify them (360 Capital Financial suddenly became 360 Blockchain), over-the-counter stocks, foreign small caps and recent IPOs.”

Shortly thereafter, Long Island Iced Tea Corporation – literally, guys who make Continue reading

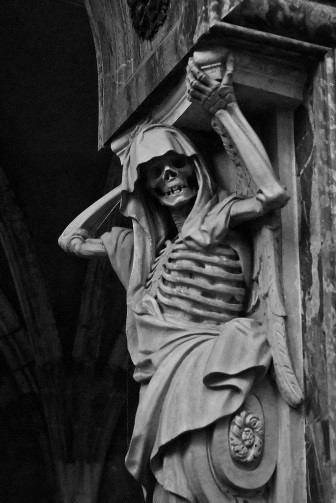

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se.

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se. fund investing in firms that are either in or are substantially tied to, the emerging markets. Overseas has a much lower market cap reflecting, in part, New World’s investments in huge multinational corporations that have substantial interests in the emerging world. Both funds have about 8% cash and portfolios that are reassuringly out-of-step with their peers; that is, both

fund investing in firms that are either in or are substantially tied to, the emerging markets. Overseas has a much lower market cap reflecting, in part, New World’s investments in huge multinational corporations that have substantial interests in the emerging world. Both funds have about 8% cash and portfolios that are reassuringly out-of-step with their peers; that is, both