Each month, many funds under partial or complete changes in their management teams. Most are inconsequential, because they involve marginal changes in teams or the substitution of one inoffensive MBA-holder for another. Because bond fund managers, traditionally, had made relatively modest impacts of their funds’ absolute returns, Manager Changes typically highlights changes in equity and hybrid funds.

Out of this month’s 40 tracked changes, the switch to AMG Managers Fairpointe Focused Equity Fund – which places star manager Thyra Zerhusen solely in charge of a struggling small fund – is interesting and the announcement that Salim Hart and Sam Chamovitz are the managers of Fidelity Low-Priced Stock Fund was briefly terrifying (the announcement did not make clear that Mr. Tillinghast remained). Jamie Harmon, has, however, Continue reading

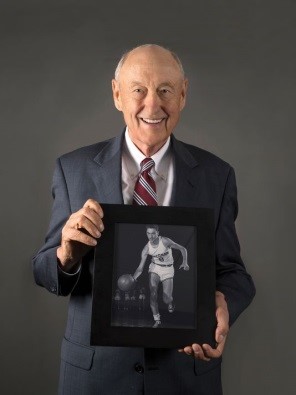

Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds,

Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds,