Objective

The fund seeks long-term capital growth by investing exclusively in stocks of companies with significant exposure (50% or more of assets or revenues) to countries with developing economies and/or markets. That investment can occur through ADRs and ADSs. Investment decisions are made in accordance with Islamic principles. The fund diversifies its investments across the countries of the developing world, industries, and companies, and generally follows a value investment style.

Adviser

Saturna Capital, of Bellingham, Washington. Saturna oversees six Sextant funds, the Idaho Tax-Free fund and four Amana funds. They have about $4 billion in assets under management, the great bulk of which are in the Amana funds. The Amana funds invest in accord with Islamic investing principles. The Income Fund commenced operations in June 1986 and the Growth Fund in February, 1994. Mr. Kaiser was recognized as the best Islamic fund manager for 2005.

Manager

Scott Klimo, Monem Salam, Levi Stewart Zurbrugg.

Mr. Klimo is vice president and chief investment officer of Saturna Capital and a deputy portfolio manager of Amana Income and Amana Developing World Funds. He joined Saturna Capital in 2012 as director of research. From 2001 to 2011, he served as a senior investment analyst, research director, and portfolio manager at Avera Global Partners/Security Global Investors. His academic background is in Asian Studies and he’s lived in a variety of Asian countries over the course of his professional career. Monem Salam is a portfolio manager, investment analyst, and director for Saturna Capital Corporation. He is also president and executive director of Saturna Sdn. Bhd, Saturna Capital’s wholly-owned Malaysian subsidiary. Mr. Zurbrugg is a senior investment analyst and portfolio manager for Saturna Capital Corporation.

Mr. Klimo joined the fund’s management team in 2012 and worked with Amana founder Nick Kaiser for nearly five years. Mr. Salam joined in 2017 and Mr. Zurbrugg in 2020.

Inception

September 28, 2009.

Management’s Stake in the Fund

Mr. Klimo has a modest personal investment of $10,000 – 50,000 in the fund. Mr. Salam has invested between $100,000 – 500,000. Mr. Zurbrugg has a nominal investment of under $10,000.

Minimum investment

$250 for all accounts, with a $25 subsequent investment minimum. That’s blessedly low.

Expense ratio

1.21% on AUM of $29.4M, as of June 2023. That’s up about $4 million since March 2011. There’s also a 2% redemption fee on shares held fewer than 90 days.

Comments

Our 2011 profile of AMDWX recognized the fund’s relatively poor performance. From launch to the end of 2011, a 10% cumulative gain against a 34% gain for its average peer over the same period. I pointed out that money was pouring into emerging market stock funds at the rate of $2 billion a week and that many very talented managers (including the Artisan International Value team) were heading for the exits. The question, I suggested, was “will Amana’s underperformance be an ongoing issue? No.”

Over the following 12 months (through April 2012), Amana validated that conclusion by finishing in the top 5% of all emerging markets stock funds.

Our conclusion in May 2011 was, “if you’re looking for a potential great entree into the developing markets, and especially if you’re a small investors looking for an affordable, conservative fund, you’ve found it!”

That confidence, which Mr. Kaiser earned over years of cautious, highly-successful investing, has been put to the test with this fund. It has trailed the average emerging markets equities fund in eight of its 10 quarters of operation and finished at the bottom of the emerging markets rankings in 2010 and 2012 (through April 29).

What should you make of that pattern: bottom 1% (2010), top 5% (2011), bottom 3% (2012)?

Cash and crash.

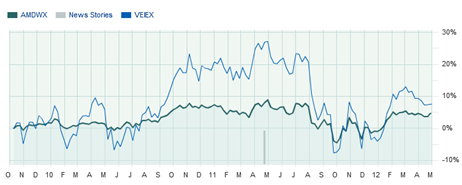

For a long while, the majority of the fund’s portfolio has been in cash: over 50% at the end of March 2011 and 47% at the end of March 2012. That has severely retarded returns during rising markets but substantially softened the blow of falling ones. Here is AMDWX, compared with Vanguard Emerging Markets Stock Index Fund (VEIEX):

The index leads Amana by a bit, cumulatively, but that lead comes at a tremendous cost. The volatility of the VEIEX chart helps explain why, over the past five years, its investors have managed to pocket only about one-third of the fund’s nominal gains. The average investor arrives late, leaves early and leaves poor.

How should investors think about the fund as a future investment? Manager Nick Kaiser made a couple important points in a late April 2012 interview.

- This fund is inherently more conservative than most. Part of that comes from its Islamic investing principles which keep it from investing in highly-indebted firms and financial companies, but which also prohibit speculation. That latter mandate moves the fund toward a long-term ownership model with very low turnover (about 2% per year) and it keeps the fund away from younger companies whose prospects are mostly speculative.In addition to the sharia requirements, the management also defines “emerging markets companies” as those which derive half of their earnings or conduct half of their operations in emerging markets. That allows it to invest in firms domiciled in the US. Apple (AAPL), not a fund holding, first qualified as an emerging markets stock in April 2012. The fund’s largest holding, as of March 2012, was VF Corporation (VFC) which owns the Lee, Wrangler, Timberland, North Face brands, among others. Mead Johnson (MJN), which makes infant nutrition products such as Enfamil, was fourth. Those companies operate with considerably greater regulatory and product safety scrutiny than might operate in many developing nations. They’re also less volatile than the typical e.m. stock.

- The managers are beginning to deploy their cash. At the end of April 2012, cash was down to 41% (from 47% a month earlier). Mr. Kaiser notes that valuations, overall, are “a bit more attractive” and, he suspects, “the time to be invested is approaching.”

Bottom line

Mr. Kaiser is a patient investor, and would prefer shareholders who are likewise patient. His generally-cautious equity selections have performed well (the average stock in the portfolio is up 12% as of late April 2012, matching the performance of the more-speculative stocks in the Vanguard index) and he’s now deploying cash into both U.S. and emerging markets-domiciled firms. If markets turn choppy, this is likely to remain an island of comfortable sanity. If, contrarily, emerging markets somehow soar in the face of slowing growth in China (often their largest market), this fund will continue to lag. Much of the question in determining whether the fund makes sense for you is whether you’re willing to surrender the dramatic upside in order to have a better shot at capital preservation in the longer term.

Company link

2013 Q3 Report

[cr2012]