By David Snowball

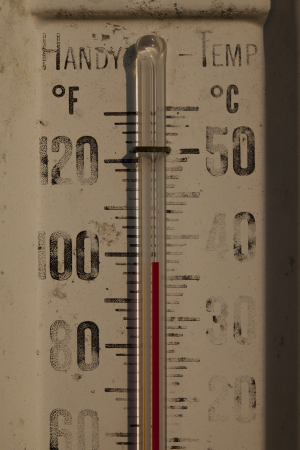

photo by rcbodden on Flickr.

Dear friends,

“Summertime and the livin’ is easy”?

“Roll out those lazy, hazy, crazy days of summer,

Those days of soda and pretzels and beer”

“That’s when I had most of my fun back …

Hot fun in the summertime.”

“In summer, the song sings itself.”

What a crock. I’m struck by the intensity of the summer storms, physical and financial. As I write, millions are without power along the Eastern seaboard after a ferocious storm that pounded the Midwest, roared east and killed a dozen. Wildfires continue unchecked in the west and the heat and drought in Iowa have left the soil in my yard fissured and hard. Conditions in the financial markets are neither better nor more settled. The ferocious last day rally in June created the illusion of a decent month, when in fact it was marked by a series of sharp, panicky dislocations.

I’m struck, too, by the ways in which our political leaders have responded, which is to say, idiotically. Republicans continue to deny the overwhelming weight of climate science. Democrats acknowledge it, then freeze for fear of losing their jobs. And both sides’ approach to the post-election fiscal cliff is the same: “let’s get through the election first.”

It’s striking, finally, how rarely the thought “let’s justify being elected” seems to get any further than “let’s convince voters that the other side is worse.”

Snippets from MIC

I had the pleasure of attending the Morningstar Investment Conference in late June. The following stories are derived from my observations there. I also had an opportunity to interview two international value managers, David Marcus of Evermore and Eric Bokota of FPA, there. Those interviews will serve as elements of an update of the Evermore Global Value profile and a new FPA International Value profile, both in August.

David Snowball at MIC, courtesy of eventtoons.com

BlackRock and the Graybeards

On Day One of the conference, Morningstar hosted a keynote panel titled “A Quarter-Century Club” in which a trio of quarter-centenarians (Susan Byrne, Will Danof and Brian Rogers) reflected in their years in the business. All three seemed to offer the same cautionary observation: “the industry has lost its moral compass.” All three referred to the pressure, especially on publicly traded firms, to “grow assets” as the first priority and “serve shareholders” somewhere thereafter.

Susan Byrne, chairman and founder of Westwood Management Corp., the investment advisor to the Westwood Funds, notes that, as a young manager, it was drilled into her head that “this is not our money.” It was money held in trust, “there are people who trust you (the manager) individually to take care for them.” That’s a tremendously important value to her but, she believes, many younger professionals don’t hear the lesson.

Will Danoff, manager of Fidelity Contrafund (FCNTX), made a thoughtful, light-hearted reference to one of his early co-workers, George. “George didn’t manage money and he didn’t manage the business. His job, so far as I can tell, was to walk up to the president every morning, look him in the eye and ask ‘how are you going to make money today for our shareholders?’ You don’t hear that much anymore.”

Brian Rogers, CIO of T Rowe Price made a similar, differently nuanced point: “when we were hired, it was by far smaller firms with a sense of fiduciary obligation, not a publicly-traded company with an obligation to shareholders. Back then we learned this order of priorities: (1) your investors first, (2) your employees and then (3) your shareholders.” In an age of large, publicly-traded firms, “new folks haven’t learned that as deeply.”

As I talk with managers of small funds, I often get a clear sense of personal connection with their shareholders and a deep concern for doing right by them. In a large, revenue-driven firm, that focus might be lost.

The extent of that loss has been highlighted by some very solid reporting by Aaron Pressman and Jessica Toonkel of Reuters. Pressman and Toonkel document what looks like the unraveling of BlackRock, the world’s largest private investment manager. In short order:

- Robert Capaldi, senior client strategist for Chief Executive Laurence Fink, left.

- Susan Wagner, a founding partner and vice chairman, announced her immediate retirement. Wagner had overseen much of BlackRock’s growth-through-acquisition strategy which included purchase of Barclay’s Global Investors and Merrill Lynch’s funds, a total of $2.4 trillion in assets.

- Chief equity strategist Boll Doll announced his retirement (at 57) as evidence began to surface that his and BlackRock’s long-time claim of “proprietary” investment models was false.

- Star energy fund manager Daniel Rice resigned in the wake of criticism of his decision to invest substantial amounts of his shareholders’ money into a firm in which he had a personal, if indirect, stake. He did so without notifying anyone outside of the firm. BlackRock, reportedly, had no explanation for investors.

Insiders report to Reuters that “further senior-level changes” are imminent.

BlackRock’s plans to double its mutual fund business in the next 18 months by targeting RIAs remain in place. Why double the business? Whose interests does it serve? BlackRock has demonstrated neither any great surplus of investment talent nor of innovative investment ideas, nor can they plausibly appeal (at $4 trillion of AUM) to “economies of scale.”

No, doubling their business is in the best interests of BlackRock executives (bonuses get tied to such things) and, likely, to BlackRock shareholders. There’s no evidence for why RIAs or fundholders are anything more than tools in BlackRock’s incessant drive from growth. The American essayist and critic Edward Abbey observed, “Growth for the sake of growth is the ideology of the cancer cell.” And, apparently, of the publicly traded megacorp.

Advice from a Conservative Domestic Equity Manager: Go Elsewhere

The Quarter Century panel of senior started talking about the equity market going forward. They were uniformly, if cautiously, optimistic. Rogers drew some parallels to the economy and market of 1982. I liked Susan Byrne’s comments rather more: “It feels like 1982 when you believed that any rally was a trap, designed to fool me, humiliate me and keep me poor.” Mr. Danoff argued that global blue chips “have absolutely flat-lined for years,” and represent substantial embedded value. They argued for pursuing stocks with growing dividends, a strategy that will consistently beat fixed income or inflation.

In closing, Don Phillips asked each for one bit of closing advice or insight. Brian Rogers, T. Rowe Price’s CIO and manager of their Equity Income fund (PRFDX) offered these two:

1. it’s time to remember Buffett’s adage, “be fearful when others are greedy, and greedy when others are fearful.”

and

2. “take a look at the emerging markets again.”

That’s striking advice, given Mr. Rogers’ style: he’s famously cautious and consistent, invests in large dividend-paying companies and rarely ventures abroad (5% international, 0.25% emerging markets). He didn’t elaborate but his observation is consistent with the recurring theme, “emerging markets are beginning to look interesting again.”

Note to the Scout Funds: “See Grammarian”

The marketing slogan for the Scout Funds is “See Further.” Uhhh .. no. “Farther.” In this usage, “further” would be “additional,” as in “see further references in the footnotes.” Farther refers to distance (“dad, how much farther is it?”) which is presumably what would concern a scout.

Scout’s explanation for the odd choice: “One of our executives wanted ‘See Farther’ but discovered that some other fund company already used it and so he went with ‘See Further’ instead.”

I see.

No, I don’t. First, I can’t find a record for the “see farther” motto (though it is plausible) and, second, that still doesn’t justify an imprecise and ungrammatical slogan.

Kudos to Morningstar: They Get It Right, and Make It Right, Quickly

In June I complained about inconsistencies in Morningstar’s data reports on expense ratios and turnover, and the miserable state of the Securities and Exchange Commission database.

In June I complained about inconsistencies in Morningstar’s data reports on expense ratios and turnover, and the miserable state of the Securities and Exchange Commission database.

The folks at Morningstar looked into the problems quite quickly. The short version is this: fund filings often contain multiple versions of what’s apparently the same data point. There are, for example, a couple different turnover ratios and up to four expense ratios. Different functions, developed by different folks at different times, might inadvertently choose to pull stats from different places. Mr. Rekenthaler described them as “these funny little quirks where a product somewhere sometime decided to do something different.” Both stats are correct but also inconsistent. If they aren’t flagged so that readers can understand the differences, they can also be misleading.

Morningstar is interested in providing consistent, system-wide data. Both John Rekenthaler, vice president of research, and Alexa Auerbach in corporate communications were in touch with us within a week. Once they recognized the inconsistency, they moved quickly to reconcile it. Rekenthaler reports that their data-improvement effort is ongoing: “senior management is on a push for Morningstar-wide consistency in what data we publish and how we label the data, so we should be ferreting out the remaining oddities.” As of June 19, the data had been reconciled. Thanks to the Wizards on West Wacker for their quick work.

FBR Funds Get Sold, Quickly

On June 26 2012, FBR announced the sale of their mutual fund unit to Hennessy Advisors. Of the 10 FBR funds, seven will retain their current management teams. The managers of FBR’s Large Cap, Mid Cap and Small Cap funds are getting dumped and their funds are merging into Hennessy funds. One of the mergers (Large Cap) is likely a win for the investors. One of the mergers (Mid Cap) is a loss and the third (Small Cap) has the appearance of a disaster.

FBR Large Cap (FBRPX, 1.25% e.r., 9.2% over three years) merges into Hennessy Cornerstone Large Growth (HFLGX), three year old large value fund, 1.3% e.r., 13.8% over 3 years. Win for the FBR shareholders.

FBR Mid Cap (FBRMX, 1.35% e.r., five year return of 3.0%) merges into Hennessy Focus 30 (HFTFX), midcap fund, 1.36% e.r., five year return of 1.25%. Higher minimum, same e.r., lower returns – loss for FBR shareholders.

FBR Small Cap (FBRYX, 1.45% e.r., five year return of 4.25%) merges into Hennessy Cornerstone Growth (HGCGX), small growth fund, 1.33% e.r., five year return of (8.2). Huh? Slightly lower expenses but a huge loss in performance. The 1250 basis point difference is 5-year performance does not appear to be a fluke. The Hennessy fund is consistently at the bottom of its peer group, going back a decade. The fact that founder and CIO Neil Hennessy runs Cornerstone Growth might explain the decision to preserve the weaker fund and its strategy. This is a clear “run away!” for the FBR shareholders.

One alternative for FBRYX investors is into FBR’s own Small Cap Financial fund (FBRSX), run by Dave Ellison, FBR’s CIO. Ellison’s funds used to bear the FBR Pegasus brand. The fund only invests in the finance industry, but does it really well. That said, it’s more expensive than FBRYX with weaker returns, reflecting the sector’s disastrous decade.

The fate of FBR’s Gas Utility Index fund (GASFX) is unclear. The key question is whether Hennessy will increase fees. An FBR representative at Morningstar expressed doubt that they’d do any such thing.

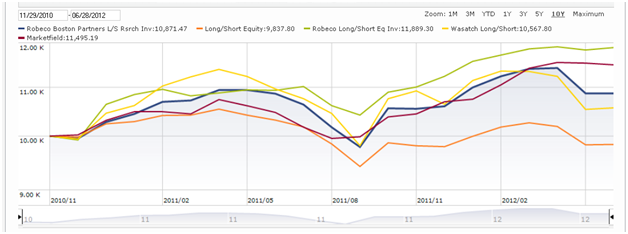

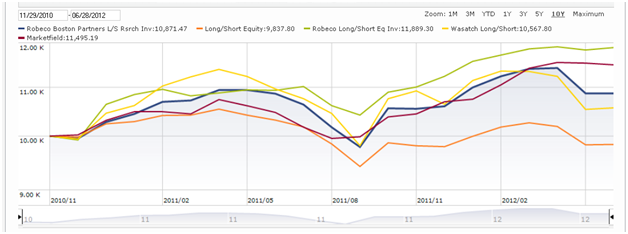

The Long-Short Summer Series: Trying to Know if You’re Winning

As part of our summer series on long-short funds, we look this month at the performance of the premier long-short funds, of interesting newcomers, and of two benchmarks.

The challenge is to know when you’re winning if your goal is not the easily measurable “maximum total return.” With long-short funds, you’re shooting for something more amorphous, akin to “pretty solid returns without the volatility that makes me crazy.” In pursuit of funds that meet those criteria, we looked at the performance of long-short funds on one terrible day (June 1) and one great day (June 29), as well as during one terrible month (May 2012) and one really profitable period (January – June, 2012).

We looked at the return of Vanguard’s Total Stock Market Index fund for each period, and highlighted (in green) those funds which managed to lose half as much as the market in the two down periods (May and June 1) but gain at least two-thirds of the market in the two up periods. Here are the results, sorted by 2012 returns.

|

May 2012

(down)

|

June 1

(down)

|

June 29

(up)

|

2012, through July 1

|

| Royce Opportunity Select |

(6.3)

|

(4.0)

|

2.9

|

16.8

|

| RiverPark Long Short Oppy |

(5.3)

|

(2.0)

|

1.6

|

16.7 – mostly as a hedge fund

|

| Vanguard Total Stock Market |

(6.2)

|

(2.6)

|

2.6

|

9.3

|

| Marketfield |

(0.1)

|

(2.25)

|

1.2

|

8.8

|

| Vanguard Balanced Index |

(3.3)

|

(1.4)

|

1.5

|

6.5

|

| Robeco Long Short |

(0.6)

|

0.1

|

0.3

|

6.1

|

| Caldwell & Orkin Market Oppy |

0.1

|

(2.3)

|

1.5

|

4.7

|

| ASTON/River Road Long Short |

(3.1)

|

(0.2)

|

1.8

|

4.6

|

| Bridgeway Managed Volatility |

(2.4)

|

(1.8)

|

1.6

|

4.2

|

| James Long Short |

(3.0)

|

(0.9)

|

0.7

|

4.0

|

| Robeco Boston Partners Long/Short Research |

|

(4.8)

|

1.25

|

3.8

|

| RiverPark/Gargoyle Hedged Value |

(5.5)

|

(2.2)

|

1.4

|

2.7 – mostly as a hedge fund

|

| Schwab Hedged Equity |

(3.3)

|

(1.7)

|

1.9

|

2.5

|

| GRT Absolute Return |

(2.0)

|

(0.1)

|

1.4

|

1.7

|

| Wasatch Long-Short |

(6.3)

|

(1.3)

|

2.0

|

1.3

|

| Forester Value |

(0.5)

|

0.25

|

0.8

|

1.2

|

| ASTON/MD Sass Enhanced Equity |

(4.4)

|

(0.6)

|

1.5

|

1.1

|

| Turner Spectrum |

(2.5)

|

(0.6)

|

0.4

|

(0.1)

|

| Paladin Long Short |

(0.9)

|

(0.1)

|

0.1

|

(1.9)

|

| Hussman Strategic Growth |

2.8

|

1.3

|

(1.3)

|

(7.6)

|

As we noted last month, in comparing the long-term performance of long-short funds to a very conservative bond index, consistent winners are hard to find. Interesting possibilities from this list:

RiverPark Long Short Opportunity (RLSFX), which converted from an in-house hedge fund in March and which we’ll profile in August.

Marketfield (MFLDX), the mutual fund version of a global macro hedge fund, which we’re profiling this month.

ASTON/River Road Long Short (ARLSX), a disciplined little fund that we profiled last month.

New on our radar is Robeco Boston Partners Long/Short Research (BPRRX), sibling to the one indisputable gold-standard fund in the group, Robeco Long Short (BPLEX). While the two follow the same investment discipline, BPLEX has a singular focus on small and micro stocks while BPRRX has a more traditional mid- to large-cap portfolio.

The chart below tracks BPPRX against its peer group average (orange) and the group’s top funds, including BPLEX (green), Marketfield (burgundy), and Wasatch (gold). BPPRX itself is the blue line.

Since inception, BPRRX has been (1) well above average and (2) well below BPLEX. It’s worth further research.

FundReveal perspective on Long-Short funds

Our collaborators at FundReveal are back, and are weighing-in with a discussion of long-short funds based on their fine-grained daily volatility and return data. Their commentary follows, and is expanded-upon at their blog.

Nearly all of the Long-Short funds examined exhibit consistently low risk. Many of them also beat the S&P 500’s Average Daily Returns. Of the six funds analyzed by David (see bullets below) those rated as “A-Best” in one year most often beat the S&P in total returns the next year, a finding consistent with the out-of-sample forward testing that we have conducted for the entire market.

One thing that remains surprising is that the Long-Short funds great idea hasn’t really panned out. It makes such sense to use all positive and negative information about companies and securities available when investing. Doesn’t only investing long leave “money [information] on the table.” But, in general, these funds have not delivered on that perceived potential.

BPLSX, Robeco Boston Partners Long/Short Fund has been delivering. We agree with David that it can be seen as the gold standard. From FundReveal’s perspective, the fund has persistently delivered “A-Best” performance, beating the S&P on both risk and return measures. Since 2005 the fund has been rated A-Best six times and C twice. This includes a whopping 82% total return in 2009. In 2009, 2010, and 2011 positive total returns followed A Best risk return rating in the preceding year. Don’t get too excited: the fund is closed.

David has commented or will comment on the following funds in the Mutual Fund Observer.

- ARLSX – Aston/River Road Long/Short

- FMLSX – Wasatch 1st Source Long/Short

- MFLDX – Marketfield Fund

- AMBEX – Aston/River Long/Short

- JAZZX – James Advantage Long/Short

- GRTHX – GRT Absolute Return Fund

Good:

The two funds with positive investment decision-making attributes based on the FundReveal model are FMLSX and MFLDX. Both persistently deliver A-Best risk-return performance, and relatively high Persistence Ratings, a measurement of the likelihood of A performance in the future: FMLSX: 40%, and MFLDX: 44%.

Not so Good:

JAZZX has demonstrated high Volatility and low Average Daily Return relative to its peers and the S&P. It has only been in existence a short time; we have data from 2011 and 2012 YTD, but it is not faring well. A wait and see position is probably justified.

Some additional candidates for consideration garnered from the FundReveal “Best Funds List” (free the FundReveal site).

VMNFX Vanguard Market Neutral Fund. A solid low risk fund with 45% Persistence. It has not hit the ball out of the park, but the team is demonstrating good decision- making as inferred from FundReveal measurements.

ALHIX American Century Equity Market Neutral Fund. A solid fund with 4% volatility, market beating Average Daily Return in 2011, and Persistence of 44%.

FLSRX Forward Long/Short Credit Analysis Fund. This fund may not even belong in this discussion since the others are stock funds. Morningstar classifies this as an alternative bond fund. Its portfolio is nearly exclusively Muni Bonds. It is 34% Short and 132% Long in the Muni Bonds that make up 99% of its portfolio. It has low Volatility, high Average Daily Return, Persistence Rating of 44%, and extraordinary performance in down markets (32% above the S&P).

A complete version of this analysis with tables and graphics is available on the FundReveal blog.

Best of the Web: Our Summer Doldrums Edition

Our contributing editor, Junior Yearwood, in collaboration with financial planner Johanna Fox-Turner have fine-tuned their analysis of retirement income calculators, a discussion they initiated last month. In addition, Junior added a review of Chuck Jaffe’s new MoneyLife podcast. Drop by Best of the Web to sample both!

Two Funds and Why They’re Really Worth Your While

Each month, the Observer profiles between two and four mutual funds that you likely have not heard about, but really should have. Our “Most intriguing new funds: good ideas, great managers” do not yet have a long track record, but have other virtues which warrant your attention. They might come from a great boutique or be offered by a top-tier manager who has struck out on his own. The “stars in the shadows” aren’t all worthy of your “gotta buy” list, but all of them are going to be fundamentally intriguing possibilities that warrant some thought. Two intriguing funds are:

Seafarer Overseas Growth & Income (SFGIX): Andrew Foster, who performed brilliantly as a risk-conscious emerging Asia manager for Matthews, is now leading this Asia-centric diversified emerging markets fund. It builds on his years of experience and maintains its cautiousness, while adding substantial flexibility.

Marketfield (MFLDX): there are two reasons to read, now and closely, about Marketfield. One, it’s about the most successful alternative-investment fund available to retail investors. Two, it’s just been bought by New York Life and will be slapped with a front-end load come October. Investors wanting to maintain access to no-load shares need to think, now, about their options.

Rest in Peace: Industry Leaders Fund (ILFIX)

I note with sadness the closing of Industry Leaders fund, a small sensible fund run by Gerry Sullivan, a remarkably principled investor. The fund identified industries in which there was either one or two dominant players, invested equally in them and rebalanced periodically. The idea (patented) was to systematically exclude sectors where leaders never emerged or were quickly overthrown. The fund did brilliantly for the first half of its existence and passably in the second half, weighed down by exposure to global financial firms, but never managed any marketing track.

Sullivan continues as the (relatively new) manager of Vice Fund (VICEX), which has a long and oddly-distinguished record.

Briefly noted …

Several months ago we reported on the Zacks fund rating service, noting that it was sloppy, poorly explained, unclear, and possibly illogical. Doubtless emboldened by our praise, Mitch and Ben Zacks have launched two ETFs: Zacks Sustainable Dividend ETF and Zacks MLP ETF. There’s no evident need for either, an observation quite irrelevant in the world of ETFs.

Small Wins for Investors

Schwab reduced the expense ratio on Laudus Small-Cap MarketMasters (SWOSX) by 10 basis points and Laudus International MarketMasters (SWOIX) by 19 basis points.

Forward Frontier Strategy (FRNMX) has capped the fund’s expenses at 1.09 – 1.49%, depending on share class.

The three Primecap Odyssey funds (Stock POSKX, Growth POGRX and Aggressive Growth POAGX) have all dropped their 2% redemption fees. That’s not really much of a win for investors since the redemption fees are designed to discourage rapid trading of fund shares (which is a bad thing), but I take what small gains I can find.

Touchstone Emerging Markets Equity (TEMAX) has reopened to new investors after 16 months.

Former Seligman Manager in Insider-Trading Case

The SEC announced that former Seligman Communications and Information comanager Reema Shah pled guilty to securities fraud and is barred permanently from the securities industry. The SEC says that Shah and a Yahoo (YHOO) executive swapped insider tips and that the Seligman fund she comanaged and others at the firm netted a $389,000 profit from trading based on insider information on Yahoo.

Farewells

Gary Motyl, chief investment officer for the Franklin, Templeton, and Mutual Series fund families, passed away. Motyl was one of Sir John Templeton’s first hires and he’s been Franklin’s CIO for 12 years. Pending the appointment of a new CIO later this summer, his duties are being covered by three other members of Franklin’s staff.

Closings

Delaware Select Growth (DVEAX) closed to new month on June 8th.

Franklin Double Tax-Free Income (FPRTX) initiated a soft close on June 15th and will switch to a hard close on August 1st.

Prudential Jennison Health Sciences (PHLAX) closed on June 29th after siphoning up $300 million in 18 months.

For those interested, The Wall Street Journal publishes a complete closed fund list each month. It’s available online with the almost-poetic name, Table of Mutual Funds Closed to New Investors.

Old Wine, New Bottles

JPMorgan Asia Pacific Focus has changed its name to JPMorgan Asia Pacific (JASPX). The management of the team will be Mark Davids and Geoff Hoare.

Columbia Strategic Investor (CSVAX) will be renamed Columbia Global Dividend Opportunity. Actually it will become an entirely different fund under the guise of being “tweaked.” I love it when they do that. The former small cap and convertibles fund gets reborn as an all-cap global stock fund benchmarked against the MSCI All World Country Index. CSVAX’s managers have been fired and replaced by a team of guys who already run six other Columbia funds.

Ivy International Balanced (IVBAX) is being renamed Ivy Global Income Allocation. It also picked up a second manager.

Off to the Dustbin of History

September will be the last issue of SmartMoney, a magazine once head-and-shoulders sharper and more data-driven than its peers. According to a phone rep for SmartMoney, Dow is likely to convert SmartMoney.com into a pay site. Dow will, they promise, “beef up” the online version and add editorial staff. Plans have not yet been made final, but it sounds like SmartMoney subscribers will get free access to the site and might get downloadable versions of the articles.

It was a busy month for Acadia Principal Conservation Fund (APCVX). On June one, the board cut its offensively high 12(b)1 fee in half (to an industry-standard 0.25%) and dropped its expense ratio by 10 basis points. On June 25th, they closed and liquidated the fund. On the upside, the fund (mostly) preserved principal in its two years of existence. On the downside, it made no money for its investors and had a negative real return. Still, that doesn’t speak to the coherence of their planning.

Effective June 1, Bridgeway Aggressive Investors 2 (which I once dubbed “Bridgeway Not Quite So Aggressive Investors”) and Micro-Cap Limited both ceased to exist, having merged into Aggressive Investors 1 (BRAGX) and Ultra-Small Company (BRUSX). Both of the remaining funds had long, brilliant runs before getting nailed in recent years by the apparent implosion of Bridgeway’s quant models.

Fido plans to merge Fidelity Advisor Stock Selector All Cap (FARAX) into Fidelity Stock Selector All Cap (FDSSX), which would lead to an expense reduction for the Advisor shareholders. By year’s end, Fidelity will merge Mid Cap Growth (FSMGX) into Stock Selector Mid Cap Fund (FSSMX). They’ve already closed Mid Cap Growth in preparation for the move.

JPMorgan Asia Equity (JAEAX) is being liquidated on July 20, 2012. It’s a bad fund that has seen massive outflows. The managers, nonetheless, will remain with JPMorgan.

Nuveen Large Cap Value (FASKX) merges into Nuveen Dividend Value (FFEIX), also in October. That’s a win for Large Cap shareholders: they get the same management team and a comparable strategy with lower expenses.

Oppenheimer Fixed Income Active Allocation (OAFAX) will merge into Oppenheimer Global Strategic Income (OPSIX) in early October, 2012.

Victory Value (SVLSX), which spiraled from mediocre to awful in the last two years, will liquidate at the end of August. Friends and mourners still have access to Victory Special Value (SSVSX, a weak mid-cap growth fund) and Victory Established Value (VETAX, actually very solid mid-cap value fund).

I’m off to Washington for the Fourth of July week with family. Preparation for that trip and ten days of often-hectic travel in June kept me from properly thanking several contributors (thanks! A formal acknowledgement is coming!) and from completing profiles of a couple fascinating funds: Cook and Bynum (COBYX) and FPA International (FPIVX), one of which will be part of a major set of new profiles in August.

Until then, take care, keep cool and celebrate family!

I’ll be the first to admit it: I have a face made for radio and a voice made for print. Nonetheless, I was pleased to make an appearance on Chuck Jaffe’s MoneyLife radio show (

I’ll be the first to admit it: I have a face made for radio and a voice made for print. Nonetheless, I was pleased to make an appearance on Chuck Jaffe’s MoneyLife radio show (

The folks at the Observer visit scores of fund company websites each month and it’s hard to avoid the recognition that most of them are pretty mediocre. The worst of them post as little content as possible, updated as rarely as possible, signaling the manager’s complete disdain for the needs and concerns of his (and very rarely, her) investors.

The folks at the Observer visit scores of fund company websites each month and it’s hard to avoid the recognition that most of them are pretty mediocre. The worst of them post as little content as possible, updated as rarely as possible, signaling the manager’s complete disdain for the needs and concerns of his (and very rarely, her) investors. This month, Junior and I enlisted the aid of two immensely talented web designers to help us analyze three dozen small fund websites in order to find and explain the best of them. One expert is Anya Zolotusky, designer of the Observer’s site and likely star of a series of “Most Interesting Woman in the World” sangria commercials. The other is Nina Eisenman, president of Eisenman Associates and founder of FundSites, a firm which helps small to mid-sized fund companies design distinctive and effective websites.

This month, Junior and I enlisted the aid of two immensely talented web designers to help us analyze three dozen small fund websites in order to find and explain the best of them. One expert is Anya Zolotusky, designer of the Observer’s site and likely star of a series of “Most Interesting Woman in the World” sangria commercials. The other is Nina Eisenman, president of Eisenman Associates and founder of FundSites, a firm which helps small to mid-sized fund companies design distinctive and effective websites. And speaking of fall, it’s back-to-school shopping time! If you’re planning to do some or all of your b-t-s shopping online, please remember to Use the Observer’s

And speaking of fall, it’s back-to-school shopping time! If you’re planning to do some or all of your b-t-s shopping online, please remember to Use the Observer’s