By David Snowball

Dear friends,

Are you feeling better? 2011 saw enormous stock market volatility, ending with a total return of one-quarter of one percent in the total stock market. Who then would have foreseen Q1 2012: the Dow and S&P500 posted their best quarter since 1998. The Dow posted six consecutive months of gains, and ended the quarter up 8%. The S&P finished up 12% and the NASDAQ up 18% (its best since 1991).

Strong performance is typical in the first quarter of any year, and especially of a presidential election year. Investors, in response, pulled $9.4 billion out of domestic equity funds and – even with inflows into international funds – reduced their equity investments by $3.2 billion dollars. They fled, by and large, into the safety of the increasingly bubbly bond market.

It’s odd how dumb things always seem so sensible when we’re in the midst of doing them.

Do You Need Something “Permanent” in your Portfolio?

The title derives from the Permanent Portfolio concept championed by the late Harry Browne. Browne was an advertising executive in the 1960s who became active in the libertarian movement and was twice the Libertarian Party’s nominee for president of the United States. In 1981, he and Terry Coxon wrote Inflation-Proofing Your Investments, which argued that your portfolio should be positioned to benefit from any of four systemic states: inflation, deflation, recession and prosperity. As he envisioned it, a Permanent Portfolio invests:

25% in U.S. stocks, to provide a strong return during times of prosperity.

25% in long-term U.S. Treasury bonds, which should do well during deflation.

25% in cash, in order to hedge against periods of recession.

25% in precious metals (gold, specifically), in order to provide protection during periods of inflation.

The Global X Permanent ETF (PERM) is the latest attempt to implement the strategy. It’s also the latest to try to steal business from Permanent Portfolio Fund (PRPFX) which has drawn $17.8 billion in assets (and, more importantly from a management firm’s perspective, $137 million in fees for an essentially passive strategy). Those inflows reflect PRPFX’s sustained success: over the past 15 years, it has returned an average of 9.2% per year with only minimal stock market exposure.

PRPFX is surely an attractive target, since its success not attributable to Michael Cuggino’s skill as a manager. His stock picking, on display at Permanent Portfolio Aggressive Growth (PAGRX) is distinctly mediocre; he’s had one splendid year and three above-average ones in a decade. It’s a volatile fund whose performance is respectable mostly because of his top 2% finish in 2005. His fixed income investing is substantially worse. Permanent Portfolio Versatile Bond (PRVBX) and Permanent Portfolio Short Term Treasury (PRTBX) are flat-out dismal. Over the past decade they trail 95% of their peer funds. All of his funds charge above-average expenses. Others might conclude that PRPFX has thrived despite, rather than because of, its manager.

Snowball’s annual rant: Despite having received $48 million as his investment advisory fee (Mr. Cuggino is the advisor’s “sole member,” president and CEO), he’s traditionally been shy about investing in his funds though that might be changing. “As of April 30, 2010,” according to his Annual Report, “Mr. Cuggino owned shares in each of the Fund’s Portfolios through his ownership of Pacific Heights.” A year later, that investment is substantially higher but corporate and personal money (if any) remain comingled in the reports. In any case, he “determines his own compensation.” That includes some portion of the advisor’s profits and the $65,000 a year he pays himself to serve on his own board of trustees. On the upside, the advisor has authorized a one basis point fee waiver, as of 12/31/11. Okay, that’s over. I promise I’ll keep quiet on the topic until the spring of 2013.

It’s understandable that others would be interested in getting a piece of that highly-profitable action. It’s surprising that so few have made the attempt. You might argue that Hussman Strategic Total Return (HSTRX) offers a wave in the same direction and the Midas Perpetual Portfolio (MPERX), which invests in a suspiciously similar mix of precious metals, Swiss francs, growth stocks and bonds, is a direct (though less successful) copy. Prior to December 29, 2008, MPERX (then known as Midas Dollar Reserves) was a government money market fund. That day it changed its name to Perpetual Portfolio and entered the Harry Browne business.

A simple portfolio comparison shows that neither PRPFX nor MPERX quite matches Browne’s simple vision, nor do their portfolios look like each other.

| |

Permanent Portfolio |

Permanent ETF |

Perpetual Portfolio targets |

| Gold and silver |

24% |

25% |

25 |

| Swiss francs |

10% |

– |

10 |

| Stocks |

25% |

25% |

30 |

| Aggressive growth |

16.5 |

15 |

15 |

| Natural resource companies |

8 |

5 |

15 |

| REITs |

8 |

5 |

|

| Bonds |

34% |

50% |

35 |

| Treasuries, long term |

~8 |

25 |

|

| Treasuries, short-term |

~16 |

25 |

|

| Corporate, short-term |

6.5 |

– |

|

| |

|

|

|

| Expense ratio for the fund |

0.77% |

0.49% |

1.35% |

Should you invest in one, or any, of these vehicles? If so, proceed with extreme care. There are three factors that should give you pause. First, two of the four underlying asset classes (gold and long-term bonds) are three decades into a bull market. The projected future returns of gold are unfathomable, because its appeal is driven by psychology rather than economics, but its climb has been relentless for 20 years. GMO’s most recent seven-year asset class projections show negative real returns for both bonds and cash. Second, a permanent portfolio has a negative correlation with interest rates. That is, when interest rates fall – as they have for 30 years – the funds return rises. When interest rates rise, the returns fall. Because PRPFX was launched after the Volcker-induced spike in rates, it has never had to function in a rising rate environment. Third, even with favorable macro-economic conditions, this portfolio can have long, dismal stretches. The fund posts its annual returns since inception on its website. In the 14 years between 1988 and 2001, the fund returned an average of 4.1% annually. During those same years inflation average 3% annually, which means PRPFX offered a real return of 1.1% per year.

And, frankly, you won’t make it to any longer-term goal with 1.1% real returns.

There are two really fine analyses of the Permanent Portfolio strategy. Geoff Considine penned “What Investors Should Fear in the Permanent Portfolio” for Advisor Perspectives (2011) and Bill Bernstein wrote a short piece “Wild About Harry” for the Efficient Frontier (2010).

RiverPark Funds: Launch Alert and Fund Family Update

RiverPark Funds are making two more hedge funds available to retail investors, folks they describe as “the mass affluent.” Given the success of their previous two ventures in that direction – RiverPark/Wedgewood Fund (RWGFX) and RiverPark Short Term High Yield (RPHYX, in which I have an investment) – these new offerings are worth a serious look.

RiverPark Long/Short Opportunity Fund is a long/short fund that has been managed by Mitch Rubin since its inception as a hedge fund in the fall of 2009. The RiverPark folks believe, based on their conversation with “people who are pretty well versed on the current mutual funds that employ hedge fund strategies” that the fund has three characteristics that set it apart:

- it uses a fundamental, bottom-up approach

- it is truly shorting equities (rather than Index ETFs)

- it has a growth bias for its longs and tends to short value.

Since inception, the fund generated 94% of the stock market’s return (33.5% versus 35.8% for the S&P500 from 10/09 – 02/12) with only 50% of its downside risk (whether measured by worst month, worst quarter, down market performance or max drawdown).

While the hedge fund has strong performance, it has had trouble attracting assets. Morty Schaja, RiverPark’s president, attributes that to two factors. Hedge fund investors have an instinctive bias against firms that run mutual funds. And RiverPark’s distribution network – it’s most loyal users – are advisors and others who are uninterested in hedge funds. It’s managed by Mitch Rubin, one of RiverPark’s founders and a well-respected manager during his days with the Baron funds. The expense ratio is 1.85% on the institutional shares and 2.00% on the retail shares and the minimum investment in the retail shares is $1000. It will be available through Schwab and Fidelity starting April 2, 2012.

RiverPark/Gargoyle Hedged Value Fund pursued a covered call strategy. Here’s how Gargoyle describes their investment strategy:

RiverPark/Gargoyle Hedged Value Fund pursued a covered call strategy. Here’s how Gargoyle describes their investment strategy:

The Fund invests all of its assets in a portfolio of undervalued mid- to large-cap stocks using a quantitative value model, then conservatively hedges part of its stock market risk by selling a blend of overvalued index call options, all in a tax-efficient manner. Proprietary tools are used to maintain the Fund’s net long market exposure within a target range, allowing investors to participate as equities trend higher while offering partial protection as equities trend lower.

Since inception (January 2000), the fund has posted 900% of the S&P500’s returns (150% versus 16.4%, 01/00 – 02/12). Much of that outperformance is attributable to crushing the S&P from 2000-2002 but the fund has still outperformed the S&P in 10 of 12 calendar years and has done so with noticeably lower volatility. Because the strategy is neither risk-free nor strongly correlated to the movements of the stock market, it has twice lost a little money (2007 and 2011) in years in which the S&P posted single-digit gains.

Mr. Schaja has worked with this strategy since he “spearheaded a research effort for a similar strategy while at Donaldson Lufkin Jenrette 25 years ago.” Given ongoing uncertainties about the stock market, he argues “a buy-write strategy, owning equities and writing or selling call options on the underlying portfolio offers a very attractive risk return profile for investors. . . investors are willing to give up some upside, for additional income and some downside protection. By selling option premium of about 1 1/2% per month, the Gargoyle approach can generate attractive risk adjusted returns in most markets.”

The hedge fund has about $190 million in assets (as of 02/12). It’s managed by Joshua Parker, President of Gargoyle, and Alan Salzbank, its Managing Partner – Risk Management. The pair managed the hedge fund since inception (including of its predecessor partnership since its inception in January 1997). The expense ratio is 1.25% on the institutional shares and 1.5% on the retail shares and the minimum investment in the retail shares is $1000. The challenge of working out a few last-minute brokerage bugs means that Gargoyle will launch on May 1, 2012.

Other RiverPark notes:

RiverPark Large Growth (RPXFX) is coming along nicely after a slow start. It’s a domestic, mid- to large-cap growth fund with 44 stocks in the portfolio. Mitch Rubin, who managed Baron Growth, iOpportunity and Fifth Avenue Growth as various points in his career, manages it. Its returns are in the top 3% of large-growth funds for the past year (through March 2012), though its asset base remains small at $4 million.

RiverPark Small Cap Growth (RPSFX) continues to have … uh, “modest success” in terms of both returns and asset growth. It has outperformed its small growth peers in six of its first 17 months of operation and trails the pack modestly across most trailing time periods. It’s managed by Mr. Rubin and Conrad van Tienhoven.

RiverPark/Wedgewood Fund (RWGFX) is a concentrated large growth fund which aims to beat passive funds at their own game. It’s been consistently at or near the top of the large-growth pack since inception. David Rolfe, the manager, strikes me as bright, sensible and good-humored and the fund has drawn $200 million in assets in its first 18 months of operation.

RiverPark Short Term High Yield (RPHYX) pursues a distinctive, and distinctly attractive, strategy. He buys a bunch of securities (called high yield bonds among them) which are low-risk and inefficiently priced because of a lack of buyers. The key to appreciating the fund is to utterly ignore Morningstar’s peer rankings. He’s classified as a “high yield bond fund” despite the fact that the fund’s objectives and portfolio are utterly unrelated to such funds. It’s best to think of it as a sort of cash-management option. The fund’s worst monthly loss was 0.24% and its worst quarter was 0.07%. As of 3/28/12, the fund’s NAV ($10.00) is the same as at launch but its annual returns are around 4%.

Finally, a clarification. I’ve fussed at RiverPark in the past for being too quick to shut down funds, including one mutual fund and several actively-managed ETFs. Matt Kelly of RiverPark recently wrote to clear up my assumption that the closures were RiverPark’s idea:

Adam Seessel was the sub-adviser of the RiverPark/Gravity Long-Biased Fund. . . Adam became friendly with Frank Martin who is the founder of Martin Capital Management . . . a year ago, Frank offered Adam his CIO position and a piece of the company. Adam accepted and shortly thereafter, Frank decided that he did not want to sub-advise anyone else’s mutual fund so we were forced to close that fund.

Back in 2009, [RiverPark president Morty Schaja] teamed up with Grail Advisers to launch active ETFs. Ameriprise bought Grail last summer and immediately dismissed all of the sub-advisers of the grail ETFs in favor of their own managers.

Thanks to Matt for the insight.

FundReveal, Part 2: An Explanation and a Collaboration

For our “Best of the Web” feature, my colleague Junior Yearwood sorts through dozens of websites, tools and features to identify the handful that are most worth your while. On March 1, he identified the low-profile FundReveal service as one of the three best mutual fund rating sites (along with Morningstar and Lipper). The award was made based on the quality of evidence available to corroborate a ratings system and the site’s usability.

Within days, a vigorous and thoughtful debate broke out on the Observer’s discussion board about FundReveal’s assumptions. Among the half dozen questions raised, two in particular seemed to resonate: (1) isn’t it unwise to benchmark everything – including gold and short-term bond funds – against the risk and return profile of the S&P 500? And (2) you assume that past performance is not predictive, but isn’t your system dependent on exactly that?

I put both of those questions to the guys behind FundReveal, two former Fidelity executives who had an important role to play in changing the way trading decisions were made and employees rewarded. Here’s the short version of their answers. Fuller versions are available on their blog.

(1) Why does FundReveal benchmark all funds against the S&P? Does the analysis hold true if other benchmarks are used?

FundReveal uses the S&P 500 as a single, consistent reference for comparing performance between funds, for 4 of its 8 measures. The S&P also provides a “no-brainer” alternative to any other investments, including mutual funds. If an investor wishes to participate in the market, without selecting specific sectors or securities, an S&P 500 index fund or ETF provides that alternative.

Four of FundReveal’s eight measurements position funds relative to the index. Four others are independent of the S&P 500 index comparison.

An investor can compare a fund’s risk-return performance against any index fund by simply inserting the symbol of an index fund that mimics the index. Then the four absolute measures for a fund (average daily returns, volatility of daily returns, worst case return and number of better funds) can be compared against the chosen index fund.

ADR and Volatility are the most direct and closest indicators of a mutual fund’s daily investment and trading decisions. They show how well a fund is being managed. High ADR combined with low Volatility are indicators of good management. Low ADR with high Volatility indicates poor management.

(2) Why is it that FundReveal says that past total returns are not useful in deciding which funds to invest in for the future? Why do your measures, which are also calculated from past data, provide insight into future fund performance?

Past total returns cannot indicate future performance. All industry performance ratings contain warnings to this effect, but investors continue using them, leading to “return chasing investor behavior.”

[A conventional calculations of total return] includes the beginning and ending NAV of a fund, irrespective of the NAVs of the fund during the intervening time period. For example, if a fund performed poorly during most of the days of a year, but its NAV shot up during the last week of the year, its total return would be high. The low day-to-day returns would be obscured. Total Return figures cannot indicate the effectiveness of investment decisions made by funds every day.

Mutual funds make daily portfolio and investment decisions of what and how much to hold, sell or buy. These decisions made by portfolio managers, supported by their analysts and implemented by their traders, produce daily returns: positive some days, and negative others. Measuring their average daily values and their variability (Volatility) gives direct quantitative information about the effectiveness of the daily investment decisions. Well managed funds have high ADR and low Volatility. Poorly managed funds behave in the opposite manner.

I removed a bunch of detail from the answers. The complete versions of the S&P500 benchmark and past performance as predictor are available on their blog.

My take is two-fold: first, folks are right in criticizing the use of the S&P500 as a sole benchmark. An investor looking for a conservative portfolio would likely find himself or herself discouraged by the lack of “A” funds. Second, the system itself remains intriguing given the ability to make more-appropriate comparisons. As they point out in the third paragraph, there are “make your own comparison” and “look only at comparable funds” options built into their system.

In order to test the ability of FundReveal to generate useful insights in fund selection, the Observer and FundReveal have entered into a collaborative arrangement. They’ve agreed to run analyses of the funds we profile over the next several months. We’ll share their reasoning and bottom line assessment of each fund, which might or might not perfectly reflect our own. FundReveal will then post, free, their complete assessment of each fund on their blog. After a trial of some months, we’re hoping to learn something from each other – and we’re hoping that all of our readers benefit from having a second set of eyes looking at each of these funds.

Both the Tributary and Litman Gregory profiles include their commentary, and the link to their blog appears at the end of each profile. Please do let me know if you find the information helpful.

Lipper: Your Best Small Fund Company is . . .

Lipper: Your Best Small Fund Company is . . .

GuideStone Funds.

GuideStone Funds?

Uhh … Lipper’s criterion for a “small” company is under $40 billion under management which is, by most standards, not small. Back to GuideStone.

From their website: “GuideStone Funds, a controlled affiliate of GuideStone Financial Resources, provides a diversified family of Christian-based, socially screened mutual funds.”

Okay. In truth, I had no prior awareness of the family. What I’ve noticed since the Lipper awards is that the funds have durn odd names (they end in GS2 or GS4 designations), that the firm’s three-year record (on which Lipper made their selection) is dramatically better than either the firm’s one-year or five-year record. That said, over the past five years, only one GuideStone fund has below-average returns.

Fidelity: Thinking Static

As of March 31, 2012, Fidelity’s Thinking Big viral marketing effort has two defining characteristics. (1) it has remained unchanged from the day of its launch and (2) no one cares. A Google search of the phrase Fidelity +”Thinking Big” yields a total of six blog mentions in 30 days.

Morningstar: Thinking “Belt Tightening”

Crain’s Chicago Business reports that Morningstar lost a $12 million contact with its biggest investment management client. TransAmerica Asset Management had relied on Morningstar to provide advisory services on its variable annuity and fund-of-funds products. The newspaper reports that TransAmerica simplified things by hiring Tim Galbraith, Morningstar’s director of alternative investments, to handle the work in-house. TransAmerica provided about 2% of Morningstar’s revenue last year.

Given the diversity of Morningstar’s global revenue streams, most reports suggest this is “unfortunate” rather than “terrible” news, and won’t result in job losses. (source: “Morningstar loses TransAmerica work,” March 27 2012)

James Wang is not “the greatest investor you’ve never heard of”

Investment News gave that title to the reclusive manager of the Oceanstone Fund (OSFDX) who was the only manager to refuse to show up to receive a Lipper mutual fund award. He’s also refused all media attempts to arrange an interview and even the chairman of his board of trustees sounds modestly intimidated by him. Fortune has itself worked up into a tizzy about the guy.

Nonetheless, the combination of “reclusive” and an outstanding five-year record still don’t add up to “the greatest investor you’ve never heard of.” Since you read the Observer, you’ve surely heard of him, repeatedly. As I’ve noted in a February 2012 story:

- the manager’s explanation of his investment strategy is nonsense. He keeps repeating the magic formula: IV = IV divided by E, times E. No more than a high school grasp of algebra tells you that this formula tells you nothing. I shared it with two professors of mathematics, who both gave it the technical term “vacuous.” It works for any two numbers (4 = 4 divided by 2, times 2) but it doesn’t allow you to derive one value from the other.

- the shareholder reports say nothing. The entire text of the fund’s 2010 Annual Report, for example, is three paragraph. One reports the NAV change over the year, the second repeats the formula (above) and the third is vacuous boilerplate about how the market’s unpredictable.

- the fund’s portfolio turns over at triple the average rate, is exceedingly concentrated (20 names) and is sitting on a 30% cash stake. Those are all unusual, and unexplained.

That’s not evidence of investing genius though it might bear on the old adage, “sometimes things other than cream rise to the top.”

Two Funds and Why They’re Really Worth Your While

Each month, the Observer profiles between two and four mutual funds that you likely have not heard about, but really should have.

Litman Gregory Masters Alternative Strategies (MASNX): Litman Gregory has assembled four really talented teams (order three really talented teams and “The Jeffrey”) to manage their new Alternative Strategies fund. It has the prospect of being a bright spot in valuable arena filled with also-ran offerings.

Tributary Balanced, Institutional (FOBAX): Tributary, once identified with First of Omaha bank and once traditionally “institutional,” has posted consistently superb returns for years. With a thoughtfully flexible strategy and low minimum, it deserves noticeably more attention than it receives.

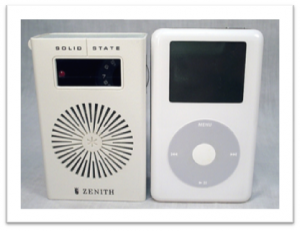

The Best of the Web: A Week of Podcasts

Our second “Best of the Web” feature focuses on podcasts, portable radio for a continually-connected age. While some podcasts are banal, irritating noise (Junior went through a month’s worth of Advil to screen for a week’s worth of podcasts), others offer a rare and wonderful commodity: thoughtful, useful analysis.

In “A Week of Podcasts,” Junior and I identified four podcasts to help power you through the week, three to help you unwind and (in an exclusive of sorts) news of Chuck Jaffe’s new daily radio show, MoneyLife with Chuck Jaffe.

We think we’ve done a good and honest job but Junior, especially, would like to hear back from readers about how the feature works for you and how to make it better, about sites we’ve missing and sites we really shouldn’t miss. Drop us a line, we read and appreciate everything and respond to as much as we can.

Briefly noted . . .

Seafarer Overseas Growth and Income (SFGIX), managed by Andrew Foster, is up about 3% since its mid-February launch. The average diversified emerging markets fund is flat over the same period. The fund is now available no-load/NTF at Schwab and Scottrade. For reasons unclear, the Schwab website (as of 3/31/12) keeps saying that it’s not available. It is available and the Seafarer folks have been told that the problem lies in Schwab’s website, portions of which only update once a month. As a result, Seafarer’s availability may not be evident until April 11..

On the theme of a very good fund getting dramatically better, Villere Balanced Fund (VILLX) has reduced its capped expense ratio from 1.50% to 0.99%. While the fund invests about 60% of the portfolio in stocks, its tendency to include a lot of mid- and small-cap names makes it a lot more volatile than its peers. But it’s also a lot more rewarding: it has top 1% returns among moderate allocation funds for the past three-, five- and ten-year periods (as of 3/30/2012). Lipper recently recognized it as the top “Mixed-Asset Target Allocation Growth Fund” of the past three and five years.

Arbitrage Fund (ARBFX) reopened to investors on March 15, 2012. The fund closed in mid-2010 was $2.3 billion in assets and reopened with nearly $3 billion. The management team has also signed-on to subadvise Litman Gregory Masters Alternative Strategies (MASNX), a review of which appears this month.

Effective April 30, 2012, T. Rowe Price High Yield (PRHYX, and its advisor class) will close to new investors. Morningstar rates it as a Four Star / Silver fund (as of 3/30/2012).

Neuberger Berman Regency (NBRAX) has been renamed Neuberger Berman Mid Cap Intrinsic Value and Neuberger Berman Partners (NPNAX) have been renamed Neuberger Berman Large Cap Value. And, since there already was a Neuberger Berman Large Cap Value fund (NVAAX), the old Large Cap Value has now been renamed Neuberger Berman Value. This started in December when Neuberger Berman fired Basu Mullick, who managed Regency and Partners. He was, on whole, better than generating high volatility than high returns. Partners, in particular, is being retooled to focus on mid-cap value stocks, where Mullick tended to roam.

American Beacon announced it will liquidate American Beacon Large Cap Growth (ALCGX) on May 18, 2012 in anticipation of “large redemptions”. American Beacon runs the pension plan for American Airlines. Morningstar speculates that the termination of American’s pension plan might be the cause.

Aberdeen Emerging Markets (GEGAX) is merging into Aberdeen Emerging Markets Institutional (ABEMX). Same managers, same strategies. The expense ratio will drop substantially for existing GEGAX shareholders (from 1.78% to 1.28% or so) but the investment minimum will tick up from $1000 to $1,000,000.

Schwab Premier Equity (SWPSX) closed at the end of March as part of the process of merging it into Schwab Core Equity (SWANX).

Forward is liquidating Forward International Equity Fund, effective at the end of April. The combination of “small, expensive and mediocre” likely explains the decision.

Invesco has announced plans to merge Invesco Capital Development (ACDAX) into Invesco Van Kampen Mid Cap Growth (VGRAX) and Invesco Commodities Strategy (COAAX) Balanced-Risk Commodity Strategy (BRCAX). In both mergers, the same management team runs both funds.

Allianz is merging Allianz AGIC Target (PTAAX) into Allianz RCM Mid-Cap (RMDAX), a move which will bury Target’s large asset base and modestly below-average returns into Mid-Cap’s record of modestly above-average returns.

ING Equity Dividend (IEDIX) will be rebranded as ING Large Cap Value.

Lord Abbett Mid-Cap Value (LAVLX) has changed its name to Lord Abbett Mid-Cap Stock Fund at the end of March.

Year One, An Anniversary Celebration

With this month’s issue, we celebrate the first anniversary of the Observer’s launch. I am delighted by our first year and delighted to still be here. The Internet Archive places the lifespan of a website at 44-70 days. It’s rather like “dog years.” In “website lifespan years,” we are actually celebrating something between our fifth and eighth anniversary. In truth, there’s no one we’d rather celebrate it with that you folks.

Highlights of a good year:

- We’ve seen 65,491 “Unique Visitors” from 103 countries. (Fond regards to Senegal!).

- Outside North America, Spain is far and away the source of our largest number of visits. (Gracias!)

- Junior’s steady dedication to the site and to his “Best of the Web” project has single-handedly driven Trinidad and Tobago past Sweden to 24th place on our visitor list. His next target: China, currently in 23rd.

- 84 folks have made financial contributions (some more than once) to the site and hundreds of others have used our Amazon link. We have, in consequence, ended our first year debt-free, bills paid and spirits high. (Thanks!)

- Four friends – Chip, Anya, Accipiter, and Junior – put in an enormous number of hours behind the scenes and under the hood, and mostly are compensated by a sense of having done something good. (Thank you, guys!)

- We are, for many funds, one of the top results in a Google search. Check PIMCO All-Asset All-Authority (#2 behind PIMCO’s website), Seafarer Overseas Growth & Income (#4), RiverPark Short Term High Yield (#5), Matthews Asia Strategic Income (#6), Bretton Fund (#7) and so on.

That reflects the fact that we – you, me and all the folks here – are doing something unusual. We’re examining funds and opportunities that are being ignored almost everywhere else. The civility and sensibility of the conversation on our discussion board (where a couple hundred conversations begin each month) and the huge amount of insight that investors, fund managers, journalists and financial services professionals share with me each month (you folks write almost a hundred letters a month, almost none involving sales of “v1agre”) makes publishing the Observer joyful.

We have great plans for the months ahead and look forward to sharing them with you.

See you in a month!

RiverPark/Gargoyle Hedged Value Fund pursued a covered call strategy. Here’s how Gargoyle describes their investment strategy:

RiverPark/Gargoyle Hedged Value Fund pursued a covered call strategy. Here’s how Gargoyle describes their investment strategy: Lipper: Your Best Small Fund Company is . . .

Lipper: Your Best Small Fund Company is . . .

Just as transistors have been succeeding by microchips, a third of all adults and 20% of smartphone users listen to radio via the internet. Half of them take radio in the form of podcasts, portable snippets of radio that they can listen to as they unwind at home (71%) or try to make a commute more pleasant and productive (45%). Some of us (*cough* Snowball *cough*) even use them to make time at the gym more bearable.

Just as transistors have been succeeding by microchips, a third of all adults and 20% of smartphone users listen to radio via the internet. Half of them take radio in the form of podcasts, portable snippets of radio that they can listen to as they unwind at home (71%) or try to make a commute more pleasant and productive (45%). Some of us (*cough* Snowball *cough*) even use them to make time at the gym more bearable.

On to the weekend!

On to the weekend! An Update: MoneyLife is Here!

An Update: MoneyLife is Here!