It’s been a quiet month for new registrants. There’s the usual collection of trendy ETFs (e.g., Pacer US Cash Cows 100 ETF) and Mr. Greenblatt is launching more Gorham-branded institutional funds (Gotham Neutral 500 at 1.4%, Defensive Long at 2.15%, and Defensive Long 500 at 1.65%). Other than that, we found just four new no-load, retail funds. Folks interested in social impact investing might want to put Gerstein Fisher Municipal CRA Qualified Investment Fund on their radar. Low minimum, relatively low expense, it provides individual investors a tool to support affordable housing and community development. Otherwise, the new options peaked out at “meh.” Continue reading

Manager changes, August 2016

In memoriam

With great sadness, we note the passing of two members of the investing community.

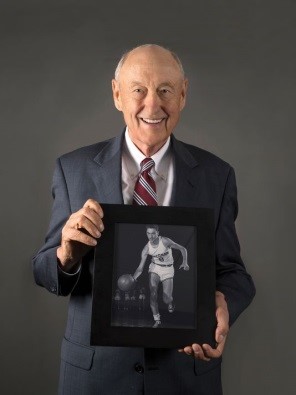

Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds, died August 4, 2016, full of years and honors, at age 85. He earned his bachelor’s degree, in the early 1950s, from the University of Wisconsin-Madison. He was deeply grateful for the scholarship that made it possible for a poor kid from Rockford, Illinois, to attend college and he repaid that kindness a thousand times over through his gifts to the university. Continue reading

Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds, died August 4, 2016, full of years and honors, at age 85. He earned his bachelor’s degree, in the early 1950s, from the University of Wisconsin-Madison. He was deeply grateful for the scholarship that made it possible for a poor kid from Rockford, Illinois, to attend college and he repaid that kindness a thousand times over through his gifts to the university. Continue reading

Briefly Noted . . .

New questions to ask your potential fund manager: “so, how did your high school lacrosse team do? And how was the cuisine in the cafeteria?” If the answers were anything close to “great” and “scrumptious,” run away! Run away! As it turns out, new research shows that managers who come from relatively modest, perhaps even challenged, backgrounds tend to surpass their J. Crew wearing peers. So if you can find a kid whose forebears were, say, poor Tennessee farmers, he probably deserves your money. (Especially if his fund is closing to new investors, say, at the end of September.) Thanks to Ira Artman, longtime reader and friend of the Observer, for the heads-up!

After 35 years with Legg Mason, Bill Miller bought himself and his funds free of them. Continue reading

August 1, 2016

Dear friends,

aAugust, famously “summer’s last messenger of misery,” is upon us. It’s a month mostly celebrated by NFL fans (for the start of training camp and the endless delusion that this might be the year) and wiccans (who apparently have a major to-do in the stinkin’ heat). All of us whose lives and livelihoods are tied to the education system feel sympathy for the poet Elizabeth M. Taylor:

August rushes by like desert rainfall,

A flood of frenzied upheaval,

Expected,

But still catching me unprepared.

Like a match flame

Bursting on the scene,

Heat and haze of crimson sunsets.

Like a dream

Of moon and dark barely recalled,

A moment,

Shadows caught in a blink.

Like a quick kiss;

One wishes for more

But it suddenly turns to leave,

Dragging summer away.

I could, I suppose, grumble again about the obvious (the combination of repeated stock market records with withering corporate fundamentals isn’t good), but Ed bade me keep silent on the topic. So we’ll try to offer up a bunch of lighter pieces, suitable to summer. Continue reading

Morningstar’s “undiscovered” funds

In case you’re wondering, here is the Observer’s mission:

The Mutual Fund Observer writes for the benefit of intellectually curious, serious investors— managers, advisers, and individuals—who need to go beyond marketing fluff, beyond computer- generated recommendations and beyond Morningstar’s coverage universe … Our special focus is on innovative, independent new and smaller funds. MFO’s mission is to provide readers with calm, intelligent arguments and to provide independent fund companies with an opportunity to receive thoughtful attention even though they might not yet have drawn billions in assets. Its coverage universe has been described as “the thousands of funds off Morningstar’s radar,” a description one fund manager echoes as “a Morningstar for the rest of us.”

Morningstar is in the business of helping investors. Since most investors have most of their money in large funds, Continue reading

Bill Gross goes commando again

Janus has announced the departure of Kumar Palghat from Janus Unconstrained Global Bond Fund (JUCAX). Mr. Palghat, a very accomplished investor with a long record of success at PIMCO and elsewhere, will become the manager of Janus Short Duration Income ETF. Mr. Palghat worked with the fund for just over one year. In his absence, Bill Gross returns to complete control. Continue reading

Third Avenue seeks a buyer

The disaster of Third Avenue Focused Credit (TFCVX) rolls on. For those not following December’s drama, TFCVX offered the impossible: it would invest in illiquid securities (that is, stuff that couldn’t be sold at the drop of a hat) but provide investors with daily liquidity (that is, act as if portions of the portfolio could be sold at the drop of a hat). That worked fine as long as the market was rising and no one actually wanted their money back, but when the tide began to go out and investors wanted their money, the poop hit the propeller. Continue reading

Have We Been Here Before?

“The past is never dead. It’s not even past.”

William Faulkner

I recently had coffee with one of my former colleagues in the investment management world. He asked me if our readers understood that, in the world of mutual fund managements, it was all about assets under management and profitability to the various stakeholders in the business. Thoughts about the returns for the investor were generally secondary, or put differently, whether the investors actually got any yachts (or vacations in the Caribbean or second homes on Hilton Head Island) did not matter. Having recently reviewed some posts on our Bulletin Board, I told him that no, many of our readers were still operating under the belief that there was, somewhere in that room full of manure, a pony.

Our desire for hope and change (at least in terms of investment returns) often leads us to ignore the evidence of simple mathematics working against us. Continue reading

Fund Facts

At the recent Chicago conference, Morningstar’s Gregg Warren stated that asset management remains an attractive business because of steady fees, high operating margins, low start-up costs, and because “investment inertia is its best friend.”

Through June there were 281 funds with assets over $10B, including 8 that have trailed their peers in absolute return by at least 1.7% per year during the current market cycle since November 2007, or about 14% or more in underperformance. (See table below, click on image to enlarge.) Most are bottom quintile performers, trail nearly 90% of their peers, and four are Three Alarm funds. They include Templeton Growth (TEPLX), Thornburg Investment Income Builder (TIBAX), Davis New York Venture (NYVTX), Fidelity Magellan (FMAGX), and American Funds’ Bond Fund of America (ABNDX) and Intermediate Bond Fund of America (AIBAX). The folks invested in these funds certainly can’t be accused of chasing returns. Continue reading

When to be Scared of the Stock Market

Sometimes it is sensible to be scared of being in the stock market. Those times are rare. I want to describe them from the perspective of a value investor, who only cares about the future cash flows of his investments; I am not offering a method of short-term market timing.

The key fact to grasp is just how resilient corporate earnings are in a big, developed country with strong institutions. The chart below shows the per-share inflation-adjusted earnings of the S&P 500 as well as its 10-year moving average. Though there are violent swings in the per-share earnings series, the moving average shows that the normalized earnings power of U.S. publicly traded corporations grew right through them, rarely reversing for long. Over this period, the U.S. experienced the Great Depression, two world wars, the Cold War, massive corporate tax hikes, oil crises, stagflation, corrupt and incompetent leaders, the 9/11 attacks, countless scandals in leading corporations, the financial crisis and so on. Continue reading