We thought we’d start catching up with the 130 U.S. equity funds which have passed their second anniversary but have not yet reached their third, which is when conventional trackers such as Morningstar and Lipper pick them up. As Charles has repeatedly demonstrated, the screener at MFO Premium allows you to answer odd and interesting questions. As I, and other users of the site, have asked him, “would it be possible to …?” Charles has almost always responded with a cheerful “let me see what I can do. I’ll get back to you.”

Two days later, the screener has Continue reading

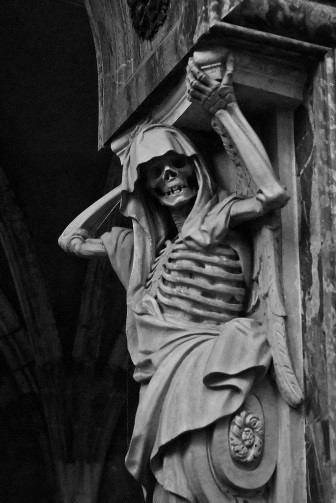

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se.

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se. fund investing in firms that are either in or are substantially tied to, the emerging markets. Overseas has a much lower market cap reflecting, in part, New World’s investments in huge multinational corporations that have substantial interests in the emerging world. Both funds have about 8% cash and portfolios that are reassuringly out-of-step with their peers; that is, both

fund investing in firms that are either in or are substantially tied to, the emerging markets. Overseas has a much lower market cap reflecting, in part, New World’s investments in huge multinational corporations that have substantial interests in the emerging world. Both funds have about 8% cash and portfolios that are reassuringly out-of-step with their peers; that is, both